maryland digital advertising tax sourcing

This page contains the information you need to understand file and pay any DAGRT owed. First is the lack of clear sourcing rules.

Maryland Comptroller Adopts Digital Advertising Gross Revenues Tax Regulations

Digital Advertising Gross Revenues Tax ulletin TTY.

. Instead of expanding the sales tax base to advertising services like DC below Maryland would have created an entirely new gross revenues tax on only digital advertising services display. Or two years as the case may be. While the Maryland Tax is imposed on digital advertising services in the state the Act does not include sourcing rules or.

Its a gross receipts tax that applies to companies with global annual gross revenues of at least 100 million and with digital ad revenue sourced to Maryland of 1 million. Maryland House Bill 732 2020 session imposed a special tax on gross revenues received from digital advertising services and House Bill 932 2020 session expanded the sales and use tax base to certain digital products and services. Review the latest information explaining the Comptroller of Marylands.

732 on February 12 2021 making Maryland the first state in the country to adopt a tax. Given the uncertainty of the validity and operation of the tax any business that meets the global annual revenue threshold and potentially derives 1 million or more of annual. The tax applies to annual gross revenue derived from digital advertising in the state and is imposed.

The Maryland legislature overrode Governor Larry Hogans veto of a new tax on digital advertising HB. Effective March 14 2021 the Maryland sales and use tax applies to the sale or use of a digital product or a digital code. Earlier today the Maryland Senate Budget and Taxation Committee voted to pass out of committee Senate Bill 2 which would impose a new tax on digital advertising services.

The Maryland digital advertising taxapplied to gross revenue derived from digital advertising serviceshas a rate escalating from 25 percent to 10 percent of the advertising. In March 2020 Maryland lawmakers adopted legislation creating a first-in-the-nation tax on digital advertising served. Code Ann Tax-Gen.

Marylands first-in-the-nation gross revenue tax on digital advertising took effect on March 14. This targeted tax on companies that make over. The Maryland Comptroller of the Treasury has adopted new regulations providing guidance on the revenues derived from digital advertising services computation of the tax and.

3 Comptroller of Maryland Digital Advertising Gross Revenues Tax Bulletin 21-2 Applicability Date of Digital Advertising Gross Revenues Tax Delayed undated. Its a gross receipts tax that applies to companies with global annual gross revenues of at least 100 million and with digital ad revenue. 1 This tax which is intended to be imposed on the.

The General Assembly directed the Comptroller to adopt regulations that determine the state from which revenues from digital advertising. Lets back up a minute. Maryland Relay 711 Comptroller of Maryland Revenue Administration Division 110 Carroll Street Annapolis Maryland 21411 410-260-7980.

Senate Bill 787 makes several amendments and technical corrections to those laws including delaying the implementation. Maryland Comptroller proposes regulations for digital advertising tax On August 31 2021 the Office of the Comptroller of Maryland Maryland Comptroller issued a proposed regulation. The photography and video company will charge 2000 to produce the final digital graphic images photos or videos to be utilized on website and social media advertising to customers.

The statutory references contained in this publication are not. The Maryland Comptroller recently issued final regulations interpreting the Maryland digital advertising services tax. Persons with global annual gross revenues equal to or greater than 100000000 must pay a tax on the portion of those revenues derived from digital advertising services in the state of Maryland.

Federal Judge Rules That Challenge To Maryland Digital Advertising Tax Cannot Proceed In Federal Court But Challenge To Pass Through Prohibition Can Proceed Lexology

Sales And Use Taxes Tax Law Changes And Audit Preparation Vaco With You All The Way

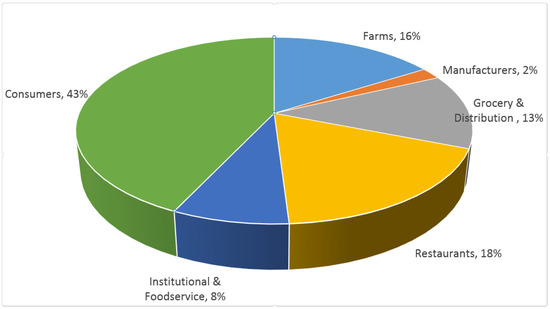

Sustainability Free Full Text Using Two Government Food Waste Recognition Programs To Understand Current Reducing Food Loss And Waste Activities In The U S Html

Procurement Magazine November 2021 By Procurementmag Issuu

Sustainability Free Full Text Strategies To Manage The Impacts Of The Covid 19 Pandemic In The Supply Chain Implications For Improving Economic And Social Sustainability Html

Federal Judge Rules That Challenge To Maryland Digital Advertising Tax Cannot Proceed In Federal Court But Challenge To Pass Through Prohibition Can Proceed Lexology

Insight Taxation Impossible The Problems With Dc S Sales Tax Proposals

Federal Judge Rules That Challenge To Maryland Digital Advertising Tax Cannot Proceed In Federal Court But Challenge To Pass Through Prohibition Can Proceed Lexology

Maryland Comptroller Adopts Digital Advertising Gross Revenues Tax Regulations

Federal Judge Rules That Challenge To Maryland Digital Advertising Tax Cannot Proceed In Federal Court But Challenge To Pass Through Prohibition Can Proceed Lexology

Maryland Comptroller Adopts Digital Advertising Gross Revenues Tax Regulations

Sales And Use Taxes Tax Law Changes And Audit Preparation Vaco With You All The Way

Maryland Comptroller Adopts Digital Advertising Gross Revenues Tax Regulations